The housing crisis is no longer just a news headline. It’s personal. It’s the reason many are stuck in shared apartments into their 30s. It’s the monthly rent reminder that makes you question your life choices. It’s reshaping everything, from how we work to when we start families, to whether we feel safe building a future in our own cities.

And it’s not just about money. It’s about stability, mental well-being, and access to opportunity. The housing crisis has gone from a market problem to a lifestyle crisis, and it’s hitting young people the hardest.

Not long ago, owning a home felt like the next step after landing a stable job. A place to settle, grow, and invest in your future. But today, that dream feels more like a myth, especially for young professionals trying to build lives in cities they can barely afford to rent in, let alone own property.

The Modern Worker’s Dilemma

Millennials were told, “Work hard, and you’ll get there.” Gen Z heard, “Be innovative, side hustle, create your own lane.” Both groups listened and did the work.

And yet, despite juggling full-time jobs, freelancing, and trying to save on coffee, the reality remains bleak. A 2023 survey from Redfin found that only 23% of millennials own homes, despite being well into their 30s. For Gen Z, that number barely cracks 12%.

We’re not just working harder than previous generations. We’re burning out faster, mentally and financially. The average down payment needed for a home in major cities now exceeds what most young professionals can save in a decade. It’s a treadmill, and we’re sprinting without moving forward.

Wages vs. Housing Inflation

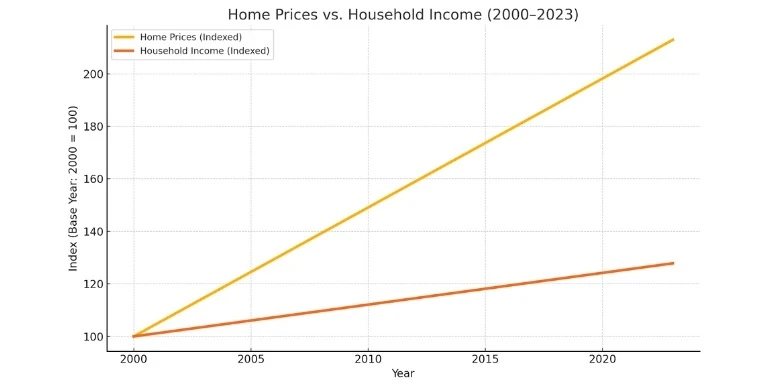

Let’s talk numbers. Between 2000 and 2023, the median home price in the U.S. rose by over 118%, while median household income rose only 28%. That’s not just a gap, it’s a canyon.

Rent isn’t faring any better. According to the Economic Policy Institute, the average worker would need to earn $25.82/hour to afford a modest two-bedroom rental. Yet, the federal minimum wage still sits at $7.25/hour.

And in many urban areas, rent eats up more than 50% of monthly income, leaving little to save. The result? Renting feels like burning money, and buying feels impossible. Either way, it’s a lose-lose game.

Mortgage Rates and Lending Barriers

The average 30-year mortgage rate in the U.S. stands at 6.76%, as of May 2025 (source: Bloomberg).

For context, in 2021, that rate was under 3%. While that might seem like a small jump, the actual impact on monthly payments is massive, easily adding hundreds of dollars per month for a median-priced home.

This spike has frozen many would-be buyers in place. With higher borrowing costs, even those with decent incomes are reconsidering homeownership. Lending standards are stricter, too, especially for self-employed professionals or gig workers, a group that now makes up over 36% of the U.S. workforce.

And globally? The situation mirrors this pattern. From the UK to Australia, rising interest rates are pushing more people out of the ownership pipeline.

Home Prices vs. Income Growth (2000–2023).

While home prices have surged by 118%, household income has only grown 28% in the same period.

(Source: U.S. Federal Housing Finance Agency & U.S. Census Bureau)

We can use this.

Rental Prices Continue to Climb

While ownership becomes harder, renting hasn’t offered much relief. Rents in major U.S. cities like New York, San Francisco, and Miami have seen increases of up to 30% since 2020 (source: Zillow).

In Canada, Toronto’s average rent for a one-bedroom hit CAD $2,500 in early 2025.

The rise in rent has outpaced wage growth in almost every major metro region. And with fewer “starter” apartments being built, the supply gap just keeps growing. Entry-level housing—once a reliable on-ramp to independence- is nearly extinct.

Young professionals are now delaying life decisions—marriage, kids, moving out—not because they want to, but because rent has become the biggest line item on their budget.

Investor Ownership and Housing Inequality

Here’s the uncomfortable truth: Housing is no longer just a human need; it’s an investment asset. In 2022 alone, investors bought one in seven U.S. homes. In some cities, that number reached one in four (source: Business Insider).

These aren’t just mom-and-pop landlords. They’re corporations, hedge funds, and large-scale property investors flipping houses for profit, turning homes into short-term rentals, or sitting on vacant properties waiting for value to rise.

This drives up prices and pulls homes out of circulation for regular buyers. It’s artificial scarcity, and it hits first-time buyers the hardest.

The result? Even when homes are available, they’re not accessible. And when they are accessible, they’re often snapped up in cash by someone who sees property not as a place to live, but a portfolio line item.

The Global Housing Crisis

From Dublin to LA: A Cross-Continental Challenge

The housing crisis isn’t just a U.S. problem. The global housing crisis is unfolding in cities across the world.

In Dublin, housing protests have surged as rent prices balloon and supply dries up. Irish officials have called the housing shortage a “national emergency”. According to The Independent, the housing crisis now threatens Ireland’s economic growth, as young workers leave the country or move back home.

In Canada, cities like Vancouver and Toronto are becoming increasingly unaffordable, with housing prices rising over 300% since the early 2000s. And yet, construction lags behind population growth.

Even in Australia, housing costs in cities like Sydney have reached record highs. The same pattern plays out: stagnant wage growth, rising construction costs, and policies that fail to meet the moment.

Meanwhile, supply chains for building materials remain fragile, labor shortages delay construction, and urban planning continues to favor luxury builds over affordable ones.

Across the board, the demand is real, the supply is low, and the crisis is deepening.

Housing has Now Become an Economic Risk

When employees can’t afford to live near their workplace, they leave, or never show up in the first place. In cities like San Francisco and New York, companies are watching talent migrate to smaller towns or switch careers altogether, just to afford rent.

In a 2024 Deloitte study, 43% of young professionals said housing costs directly impacted their decision to switch jobs or work remotely. Companies are spending more to replace staff than to retain them. It’s a lose-lose situation.

Rising cost of living pushes workers further from job hubs

As housing prices rise in urban cores, employees are forced into longer commutes and greater stress. This directly affects productivity, attendance, and job satisfaction. A tired employee commuting two hours just to afford their apartment isn’t showing up with their best ideas.

Entrepreneurship on Pause

Startups and small businesses rely on one crucial resource: founders who can take financial risks.

But when rent alone eats up over half of a paycheck, how does one take the leap into entrepreneurship? Many young people are shelving business dreams to stay employed and stay housed. Without the financial cushion that older generations built through home equity, the risk tolerance is simply gone.

The housing crisis isn’t just a personal problem; it’s stalling innovation and new business creation across the board.

Broader Economic Repercussions

Housing is a pillar of economic stability. When people can’t afford homes, they delay everything: marriage, children, savings, healthcare, and big purchases.

According to the Pew Research Center, nearly 36% of adults aged 25–34 are still living with parents or roommates. This has ripple effects across industries, from consumer goods to childcare to education.

A nation of renters with no disposable income isn’t just a demographic trend. It’s a threat to long-term economic growth.

Assessing the Proposed Solutions. Are They Enough?

There are proposed solutions, but are they enough? Let’s dive into these solutions one by one for a clearer picture.

Prefabricated Housing and Innovation Gaps

Prefab homes have been marketed as a quick fix. They’re cheaper, faster to build, and environmentally friendly. Companies like Carney Group have made headlines for pushing this model hard.

But the reality is more nuanced.

Prefab homes often face zoning barriers, limited urban land availability, and financing challenges. Many banks won’t approve traditional mortgages for prefab models. And while they can help, they’re not scaling fast enough to fill the demand.

Government Promises vs. Ground Realities

Governments love to talk about housing.

In early 2025, former President Trump proposed building homes on public land. While bold in theory, many critics argue it sidesteps deeper structural issues like zoning reform, housing finance systems, and corporate ownership regulations.

Similarly, in cities like Los Angeles and Vancouver, promises to build “affordable” housing often result in units priced well above what the median resident can afford.

Talking about the crisis won’t fix it. Execution matters.

Private Sector Involvement

The private sector, especially large developers and tech firms, often tout innovation, but rarely tackle affordability head-on.

Housing startups promise disruption. But many simply repackage luxury housing with a tech wrapper. Think “co-living” models that still charge $1,800/month for a room and shared kitchen.

What’s missing? True collaboration between the public and private sectors. And a genuine focus on affordability over aesthetics.

The Way Forward

Governments must tighten rules around investor ownership. Some potential policies include:

- Taxes on vacant homes

- Caps on the number of residential properties a single entity can own

- Restrictions on short-term rentals in housing-scarce areas

Cities like Barcelona and Vancouver have already implemented vacancy taxes and seen improvement.

Housing should first and foremost be for living, not flipping.

Innovative Housing Models for a New Era

We need to rethink how ownership works.

- Rent-to-own models can help tenants build equity over time

- Cooperative housing gives residents ownership stakes and decision-making power

- Subsidized zoning can make affordable housing profitable for developers

These are models that balance financial feasibility with long-term sustainability.

Cross-Sector Collaboration is Crucial

The government alone cannot fix this. Businesses need to step up. Community-led initiatives must be heard. Banks must update lending models to support modern buyers—gig workers, single-income families, and first-gen homeowners.

We need a new housing ecosystem, not just more homes.

Conclusion

If you’re a founder, employer, or executive, understand this: housing is a talent issue.

Support your workforce by:

- Offering relocation or housing stipends

- Supporting remote-first policies

- Advocating for local zoning reform and infrastructure investment

When people live better, they work better. Period.

Now, if you are a young professional, your frustration is valid. But your voice is powerful.

- Vote for candidates who prioritize housing reform

- Join local councils, zoning boards, or advocacy groups

- Speak up, on social media, in your company, and in your city

Owning a home shouldn’t be a luxury reserved for the few. It should be part of a stable, thriving future for everyone.

0 Responses